Aramco has been forced to delay two large expansion projects at the Marjan and Berri complexes as the impacts of the virus have been far reaching for the global economy, oil prices and demand, according to GlobalData

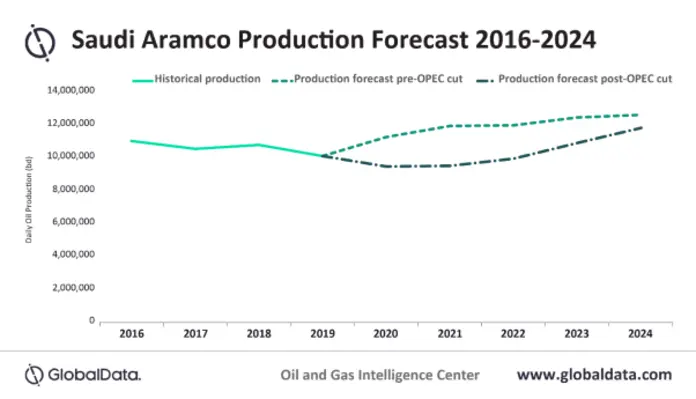

“These expansion projects aimed to add a significant amount of production to the company’s portfolio. However, the impacts of COVID-19 now represent a long-term impact and along with the OPEC+ production cuts, Saudi Arabia is likely to see significantly reduced output than would have been planned,” stated Conor Ward, oil and gas analyst at GlobalData.

The upcoming expansion plans have been delayed and Aramco will become increasingly stricter with its capital spending due to the uncertainty which COVID-19 has brought to the market. H1 spending for the company has already been 15% lower than 2019 and this trend is expected to continue into 2021 as the company continues to re-evaluate its spending habits amid a global demand reduction.

Ward concluded, “Going forward, the company will remain the largest single energy company in the world with above industry average profit margins however, continued weakness in global oil prices will put pressure on the company and in turn, the government’s fiscal budgeting.”

In commitment with the agreed OPEC+ production cuts, Saudi Arabia has cut 2.5 mmbbl of oil per day in May, June and July. In further efforts to rebalance oil prices, Saudi Arabia, the UAE and Kuwait agreed to a further 1.18 5 mmbbl of oil per day production cut of which Saudi Arabia will bare one million. Aramco will experience an approximately 18% cut in its originally planned 2020 production and with these OPEC cuts along with the impacts of COVID-19, it is unlikely that production levels will rebound before 2022.