A majority of senior oil and gas professionals believe that larger, capital-intensive oil and gas projects will be approved this year to meet the hydrocarbon demand, according to a DNV GL survey

DNV GL, a technical adviser to the energy industry, released its ninth annual report on the outlook for the oil and gas industry, which surveyed almost 800 senior industry professionals and executives.

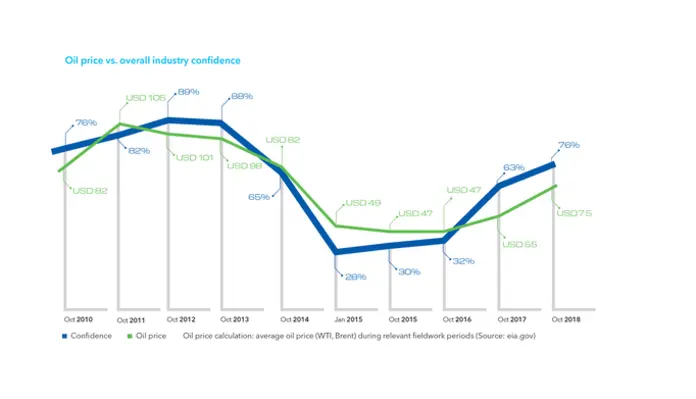

The study revealed that the outlook for the oil and gas industry stood at 76 per cent, compared to 32 per cent in 2017. In 2019, 70 per cent of senior professionals planned to increase or maintain capital expenditure and a third of senior professionals expect their workforce to grow.

Liv A. Hovem, CEO of DNV GL oil and gas, said, “Despite greater oil price volatility in recent months, our research shows that the sector appears confident in its ability to better cope with market instability and long-term lower oil and gas prices. For the most part, industry leaders now appear to be positive that growth can be achieved after several difficult years.”

“While increasing optimism and expectations for higher spending are to be welcomed, there will also be new challenges for the sector this year. The industry’s resolve to maintain the efficiencies established during the recent market downturn will be tested as the sector relaxes its focus on cost control, and signs of supply chain inflation and skills shortages emerge,” she added.

About 41 per cent of the respondents said they had experienced cost inflation from suppliers in 2018, rising beyond half in the Middle East and North Africa, and in the Asia Pacific. Skills shortages and an ageing workforce have resurfaced as a major concern.

About 41 per cent of the respondents said they had experienced cost inflation from suppliers in 2018, rising beyond half in the Middle East and North Africa, and in the Asia Pacific. Skills shortages and an ageing workforce have resurfaced as a major concern.

Digitalisation comfortably leads the R&D priorities for the oil and gas industry in 2019, with 60 per cent of DNV GL research respondents expecting their organisation to increase spending in this area in 2019.

The top three priorities in the industry’s digitalisation agenda relate to data sharing, integration and access (cloud-based applications, data platforms and data sharing between organisations). Two-thirds of respondents (67 per cent) noted that their company will prioritise the quality and availability of data in 2019.

About 51 per cent of senior industry professionals have stated that they will actively adapt to a less carbon-intensive energy mix in 2019, up from 44 per cent last year. Regulation topped the list of factors that drive oil and gas companies to decarbonise their operations in 2019.

One-third of respondents expressed that they are looking to increase their investment in renewable energy in 2019, and more than a third (35 per cent) affirmed that their organisations will increase investment in gas-focused projects and portfolios.

“Not long ago, the industry regarded the energy transition as a transformation on the horizon, however; it has become clear that this significant change is already upon us. The sooner companies’ start planning and acting, the better,” she stated.