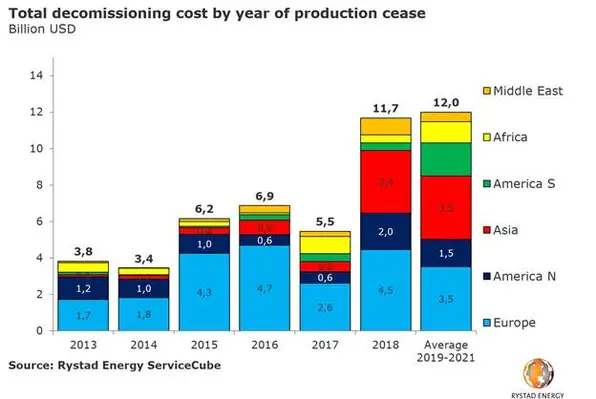

Global decommissioning in the oil and gas industry is projected to hit an average of US$12bn per year from 2019 through 2021, according to Rystad Energy, an independent energy research company

Audun Martinsen, Rystad Energy partner, said, “2018 was an all-time high, and the next years are set to break this record. To put this into context, the global oil and gas industry is facing total decommissioning obligations in the magnitude of six Johan Castberg field development projects in the Barents Sea within the next three years.”

A review of offshore assets shows that around 9,000 wells worldwide are currently struggling to remain profitable at US$60 per barrel of Brent oil prices. Rystad Energy expects these wells will be plugged and abandoned over the coming years.

“This is a relatively high breakeven price that was the Achilles heel of many fields in 2018,” he added.

“In 2013 and 2014, when oil prices were high, very few operators initiated plans to decommission older assets. Instead, they sought to maximise returns from their producing assets. However, as oil prices dropped to painfully low levels in 2015 and 2016, many of these field life extension plans were deprioritised or scrapped altogether,” he stated.

“Although oil prices have recovered to more sustainable levels, the elusive $100 dollar-barrel still seems like a distant dream for most operators. As a result, numerous operators have begun realising their obligations to decommission elderly uncompetitive assets,” he remarked.

Europe, driven in particular by the UK, has been the most active market for offshore decommissioning, with a global market share of more than 50 per cent in recent years.

In the next three years, the UK alone is expected to spend more than US$2bn annually on decommissioning activities. However, it added that decommissioning activity will also grow significantly in other parts of the world.

“In Asia, North America and Latin America, a growing number of fields are currently under evaluation for dismantlement in the face of the bearish oil market,” he concluded.