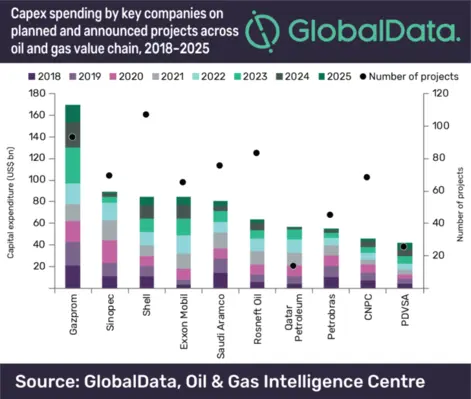

Gazprom, Russia-based natural gas company, and China Petrochemical Corp (Sinopec) will be the top spenders among global oil and gas companies, according to leading data and analytics company GlobalData

These spending will be in terms of new build capital expenditure (capex) to be spent on planned and announced projects across the oil and gas value chain during 2018-2025.

The company’s report: ‘H2 2018 Top Global Oil and Gas Companies Planned Projects and Capital Expenditure Outlook - Gazprom and Sinopec spend high across oil and gas value chain' found that Gazprom leads with an estimated capex of US$170.2bn expected to be spent on 93 oil and gas projects globally.

Sinopec and Royal Dutch Shell Plc (Shell) follow with capex of US$88.9bn (69 projects) and US$84.5bn (107 projects), respectively.

In the upstream sector, Shell leads among companies with an estimated capex of US$60.6bn to be spent on 58 planned and announced production fields globally.

Gazprom follows with US$43.6bn to be spent on 28 upstream projects and Exxon Mobil will be in third position with US$42.2bn to be spent on 34 projects.

Soorya Tejomoortula, Oil and Gas analyst at GlobalData, commented, “Gazprom’s planned and announced projects portfolio is mainly focused on gas pipelines, upstream gas projects, and gas processing plants. This will help the company to ensure an uninterrupted supply of gas to Europe and foray into new markets in Asia.”

GlobalData expects Gazprom to lead both pipelines and gas processing segments in the midstream sector, with new build capex of US$59.8bn and US$33.3bn, respectively by 2025.

In the LNG liquefaction segment, Qatar Petroleum is expected to lead with new build capex of US$34.7bn, while China National Offshore Oil Corporation leads in regasification capex with US$3.9bn, during the outlook period.

In the gas storage segment, Bendis Enerji leads with US$10.6bn and OIDB leads in liquids storage segment with capex of US$4.6bn by 2025.

Saudi Arabian Oil Co is expected to lead the downstream sector, with estimated crude oil refining capex of US$45.5bn on the development of seven crude oil refineries globally by 2025.

Petroleos de Venezuela SA and Sinopec follow with capex of US$35.2bn and US$27.6bn, expected to be spent on six new projects each, respectively.

In the petrochemical sector, Rosneft Oil is expected to lead with estimated capex of US$19.2bn to be spent on 39 upcoming petrochemical plants, followed by Dangote Industries with estimated capex of US$13.8bn expected to be spent on 13 new projects. Saudi Aramco is third with US$13.2bn expected to be spent on 38 upcoming projects.