Global installation activity and expenditure for onshore pipelines in the near-term is expected to be bolstered by a number of large pipelines in Africa, Asia, Eastern Europe and FSU, according to a report by Westwood

Westwood Global Energy Group (Westwood), an energy research, analysis and consulting specialist for exploration and oilfield services markets, has released the latest edition of Westwood’s annual World Onshore Pipelines Market Forecast 2019-2023.

As noted in the report, additional capacity in the near-term will also come from projects designed to alleviate bottlenecks in takeaway capacity in the Permian basin in the US.

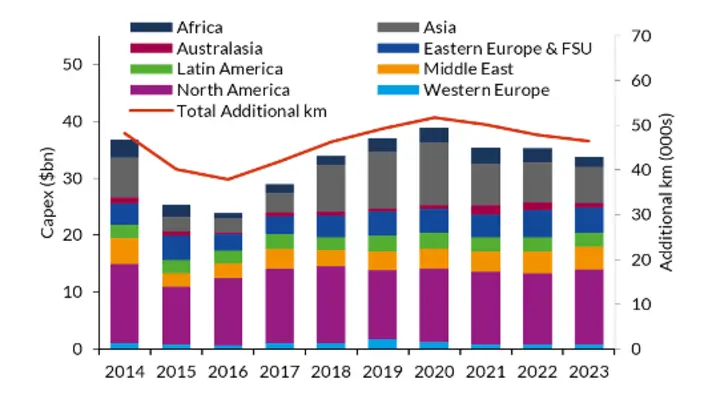

A decline in activity is expected post-2020. Some pipelines have experienced delays and cancellations since the release of the previous edition of the report, including the Trans Mountain Expansion pipeline in Canada and the Djibouti-Dire Dawa-Awash (Horn of Africa) from Djibouti to Ethiopia, it added.

Westwood expects the market to remain resilient, relative to the previous five-year period, with total forecast expenditure expected to increase by 21 per cent compared to 2014-2018, with key project announcements in 2017-2018 has resulted in an uptick in forecast expenditure for regions such as Australasia.

The report includes regional capital and operational expenditure forecasts, including examples of key countries and projects driving installation activity and expenditure within each region.

The regional forecasts for capital expenditure are provided for line pipe, right of way, fittings, stations, and construction, with operational expenditure being split in terms of operations-related expenditure, integrity management, technical and land management support, and stations.

The report provides a comprehensive technical overview of the project development process, from front-end engineering and design (FEED) through to engineering, procurement, construction (EPC), and operations and maintenance. It is, therefore, an essential tool for companies operating across the supply chain, from steel mills and original equipment manufacturers (OEMs) to pipeline operators and integrity service providers.

Westwood expects a 12 per cent increase in additional kilometres installed in the near-term (2019-2020) to be supported by a number of key projects currently under construction, including the 1,400km Hoima to Tanga crude oil pipeline from Uganda to Tanzania and the 4,000km Power of Siberia pipeline from Russia to China.

Additional projects such as the African Renaissance Project (ARP) pipeline from Mozambique to South Africa and the planned Eagle Spirit pipeline in Canada are also expected to contribute to expenditure towards the end of the forecast.