Major oil and gas companies are pursuing major production growth projects but, according to GlobalData, a data and analytics company, the value risk to these investments from the energy transition is limited

The company’s latest analysis shows that planned and announced projects from the six supermajors of ExxonMobil, Chevron, Royal Dutch Shell, BP, Total and Eni are expected to contribute more than five mmbpd of gross oil production by 2025.

This comes despite projections of declining oil demand in the 2030s or even the late 2020s in some scenarios, the report added.

Will Scargill, senior oil and gas analyst for GlobalData, said, “The risk to majors is mitigated by the fact that the bulk of their portfolio value comes from near-term revenues. Although oil and gas fields generally produce over a long period of 20-30 years, the declining nature of production means that a high proportion of cash flows come in the initial years.

A standard industry discount rate of 10 per cent puts greater emphasis on near-term revenues when assessing the value and the current focus on short-cycle projects compounds this.

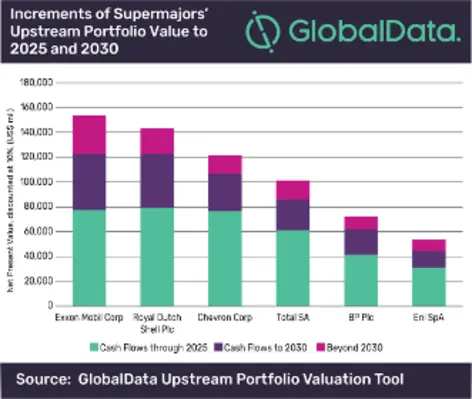

GlobalData’s analysis shows that across all the supermajors’ portfolio of existing fields and upcoming projects, more than 50 per cent of the net present value comes from cash flows up to 2025, while 80 per cent or more comes from cash flows up to 2030.

GlobalData’s analysis shows that across all the supermajors’ portfolio of existing fields and upcoming projects, more than 50 per cent of the net present value comes from cash flows up to 2025, while 80 per cent or more comes from cash flows up to 2030.

“The design of fiscal regimes also has a significant effect. In order to incentivize new developments, many governments have designed terms that allow companies to rapidly recover their investments through accelerated tax allowances, cost recovery, or other mechanisms that improve cash flows in the first years of production. This combination of factors means that new developments may be subject to the least risk from potential demand reductions,” he added.