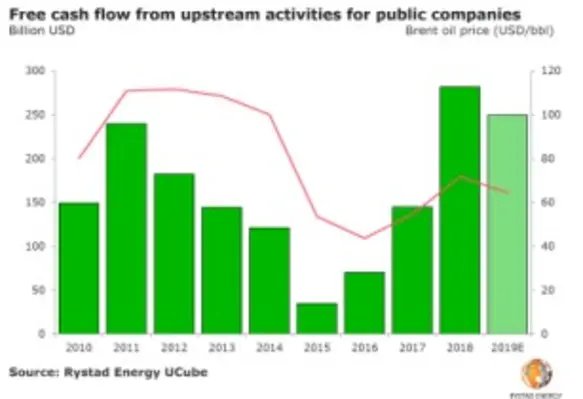

The world’s publicly listed oil and gas companies saw their free cash flow (FCF) for public exploration and production (E&P) companies soared to almost US$300bn last year and 2019 could turn out to be another blockbuster year, according to an analysis by Rystad Energy

Espen Erlingsen, head of upstream research at Rystad Energy, said, “The fact that E&P companies are able to deliver the same shareholder returns despite much lower oil prices points to an impressive increase in profitability.”

Rystad Energy’s estimated global FCF analysis for all public E&P companies since 2010 shows that FCF peaked in 2011 but declined between 2012 and 2014 due to increased budget investments and more commitments. The FCF was significantly reduced in 2015 as the oil price collapsed. Since 2015, FCF has recovered gradually to the all-time high.

“Our analysis of the latest annual reports from the majors clearly indicates that ‘super profits’ are back for large E&P companies. Free cash flow before financing activities was at a record high in 2018, and the mega profits were typically used to pay down debt and increase payments to shareholders,” he added.

Rystad Energy believes three main factors drive this increased profitability:

-Higher oil prices: The oil market has gradually returned to balance after a period of oversupply

-Lower costs: Since 2014 the cost of developing new projects has fallen on average by 30 per cent

-Lower activity: Global investments within the upstream industry have fallen from around US$900bn to US$500bn.

Rystad Energy has analysed recent cash flow statements from all the majors plus Norway’s Equinor to get a better sense of who benefits from these profits.

“Almost 70 cents for every dollar in profits generated last year for these companies ended up in shareholders’ pockets,” Erlingsen concluded.