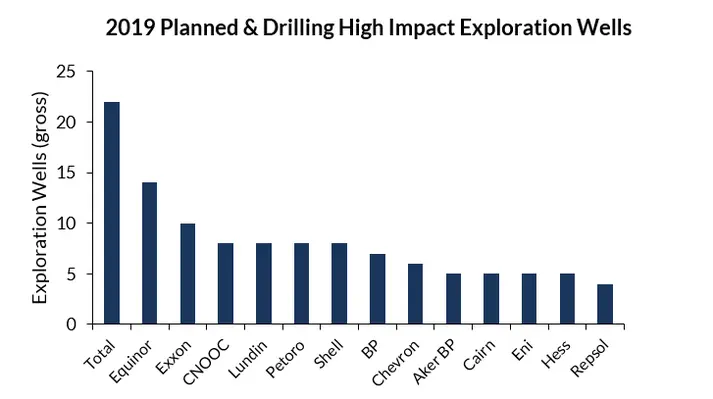

UK-based consulting firm Westwood has stated that French major Total is the company to watch out for in 2019, which plans to drill the highest number of deepwater wells this year

Total plans to drill 22 wells, eight of which are frontier playtests. The research firm’s report added that the regions to be observed are NW Europe and Central and South America, each with 22 high impact wells.

The firm remarked that conventional deepwater is fighting back, stimulated by exploration success, particularly in Guyana where more than five billion barrels have been found since 2015 with breakeven oil prices in the US$30 per barrel. The number of risky deepwater frontier wells increased from 6 in 2016 to 21 in 2018 though only 2 made commercial discoveries and both were in Guyana.

The 51 offshore project sanctions in 2018 were slightly down in 2017 but were still significantly up on 2015/16. Further progress is expected in 2019 with FIDs increasing significantly with up to 90 possible. This will bring some relief to the hard-pressed supply chain still struggling with overcapacity in most asset classes and many suppliers struggling with commercial terms. Expect to see increased contracting in 2019 but limited price inflation.

The oil price recovery that began in early 2016 and gained momentum in the second and third quarters of 2018 collapsed in the fourth quarter, with prices falling back to the long-term average of US$56 per bbl. The demand for oil and gas has never been higher with the IEA reporting demand growing 1.3 mmbbl a day to more than 100 mmbbl a day for the first time in 2018, the firm said.

The oil price recovery that began in early 2016 and gained momentum in the second and third quarters of 2018 collapsed in the fourth quarter, with prices falling back to the long-term average of US$56 per bbl. The demand for oil and gas has never been higher with the IEA reporting demand growing 1.3 mmbbl a day to more than 100 mmbbl a day for the first time in 2018, the firm said.

The firm added that the US led the supply charge in 2018 with production growing a remarkable 1.9 mmbbl a day to 11.7mn bbl a day. Political uncertainty abounds at present in all regions and this together with the biggest physical oil market ever, points to continued short term volatility in the US$50-80 per bbl Brent range.

If demand keeps rising a supply crunch will eventually drive prices higher than this band given the low levels of capital investment since 2015, but probably not in 2019. If demand growth falters, then the current oversupplied market could last longer.

The report noted that larger E&Ps were in rude financial health in 2018, particularly in Q3 when they were enjoying US$75 per barrel average revenues with breakeven costs at US$40-50 per bbl. Free cash easily covered dividends and capex and share buybacks were again in vogue. Nonetheless, caution in boardrooms remains with the focus more on sustaining profitability and dividends rather than accelerating growth. Expect modest capex increase in 2019 of 8-10 per cent.

US tight oil remains popular for its flexibility and optionality when deploying capital-it can be switched on and off depending on the oil price and returns are quick.