In 2018, about 200 new oil and gas projects, with a collective amount of US$127bn, might get approval by year-end, according to Rystad Energy

The 45 offshore projects that have been approved year-to-date are already more than the amount approved in 2016. In addition to beating 2016’s activity, this year’s offshore project sanctioning is on track to surpass 2017’s sanctioning levels by 50 per cent.

About US$34bn of onshore projects are expected to be approved in 2018. Despite a steady stream of onshore projects being sanctioned during 2018, the size of these projects varies significantly.

“This has caused a mere US$3bn increase in onshore commitments from May through September. In addition, the fourth quarter will see US$15.1bn of onshore projects approved,” said Rystad Energy.

Subsea tie backs have been favoured the most by operators in 2018. Collectively, about US$26bn in subsea tie-back projects have been approved, with an additional US$7bn forecasted by year-end.

This will give subsea contractors a potential US$7.4bn in greenfield contract opportunities over the next few years. ExxonMobil’s Neptun Deep project is poised to approve a subsea tie back to the Domino field in Romania in late-2018. The development will give US$1.5bn in new contract opportunities to service companies, including more than US$420mn in EPCI contracts. The project aims to start-up in early-2022.

The rest of the year will see more fixed facilities and floater projects approved than subsea tie backs. The Marjan Expansion project in Saudi Arabia is set to be the largest fixed facility project up for sanctioning. Once approved, it will look to award contracts in excess of US$4.6bn over the next several years, allowing Saudi Aramco to construct and install more than 20,000 tonnes of topsides for their steel platform.

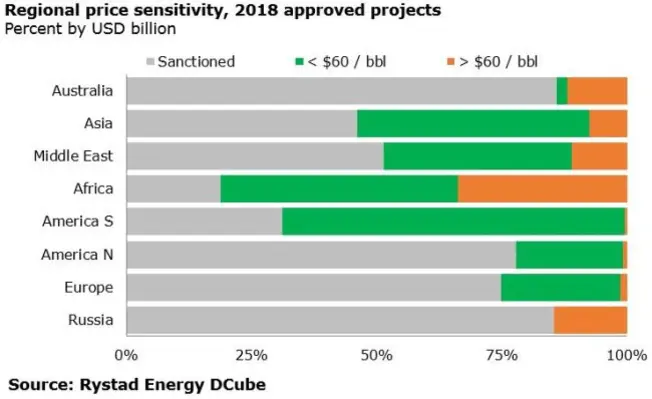

Recent cost reduction efforts have moved a few significant projects in South America below the US$60 per barrel breakeven threshold. However, there are still US$14bn to-be-sanctioned offshore and onshore projects globally for 2018 require breakeven prices above US$60 per barrel.

Total’s Lake Albert project in Uganda will look to develop their Jobi-Rii asset for more than US$2.4bn. However, the project will require a breakeven oil price above US$60 per barrel. If approved, this onshore development would target a 2022 start-up.