The 32 Member countries of the International Energy Agency have agreed to make 400 million barrels of oil from their emergency reserves available to the market, the largest release of emergency oil stocks in the Agency’s history, to address the loss of supply stemming from the war in the Middle East and the effective closure of the Strait of Hormuz

In a statement, IEA executive director Fatih Birol noted that the conflict in the Middle East is having a significant impact on global oil and gas markets, with major implications for security, affordability and the global economy.

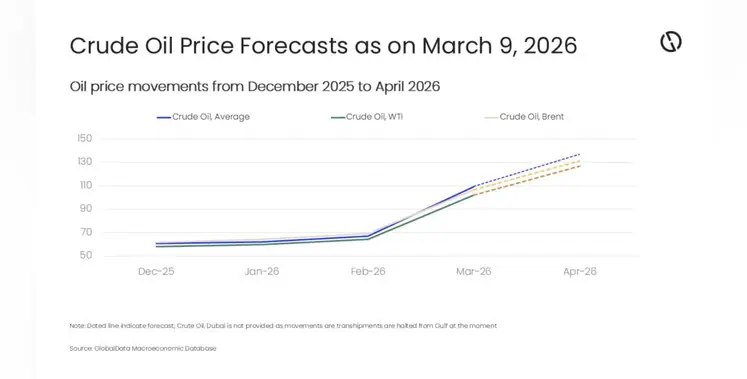

The conflict in the Middle East that began on 28 February 2026 has impeded oil flows through the Strait of Hormuz, with export volumes of crude and refined products currently at less than 10% of pre-conflict levels. Without sufficient routes to market and without sufficient storage, regional operators have been forced to shut in or curtail a substantial amount of production. They are also experiencing attacks on their energy and energy-related infrastructure.

An average of 20 million barrels per day of crude oil and oil products transited the Strait of Hormuz in 2025, or around 25% of the world’s seaborne oil trade. Options for oil flows to bypass the Strait of Hormuz are limited.

Refinery operations are also being disrupted, with implications for the jet fuel and diesel supplies.

“The situation of the natural gas markets is challenging, with few options to replace LNG cargoes from Qatar and the UAE. These have been reduced by 20%, leaving balances even tighter than for oil,” Birol remarked. Asia has been the most profoundly affected, and is forced to compete with other markets for LNG cargos.

“The oil market challenges we are facing are unprecedented in scale, therefore I am very glad that IEA Member countries have responded with an emergency collective action of unprecedented size,” said Birol. “Oil markets are global, so the response to major disruptions needs to be global too. Energy security is the founding mandate of the IEA, and I am pleased that IEA Members are showing strong solidarity in taking decisive action together.”

While this will alleviate the immediate disruption, the most important thing is to stabilise flows and allow traffic to resume through the Strait of Hormuz, he said.

The emergency stocks will be made available to the market over a timeframe that is appropriate to the national circumstances of each Member country and will be supplemented by additional emergency measures by some countries.

IEA members hold emergency stockpiles of over 1.2 billion barrels, with a further 600 million barrels of industry stocks held under government obligation. The coordinated stock release is the sixth in the history of the IEA, which was created in 1974. Previous collective actions were taken in 1991, 2005, 2011, and twice in 2022.

The IEA Secretariat will provide further details of how this collective action will be implemented in due course. It will also continue to closely monitor global oil and gas markets and to provide recommendations to Member governments, as needed.

“The IEA will continue its mission of upholding energy security, as we have done today for the oil markets, and will continue to do across the entire energy sector,” Birol concluded.